Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Juan Fonseca

Fonseca Ins and Fin Srvc Inc

Office Hours

After Hours by Appointment

Address

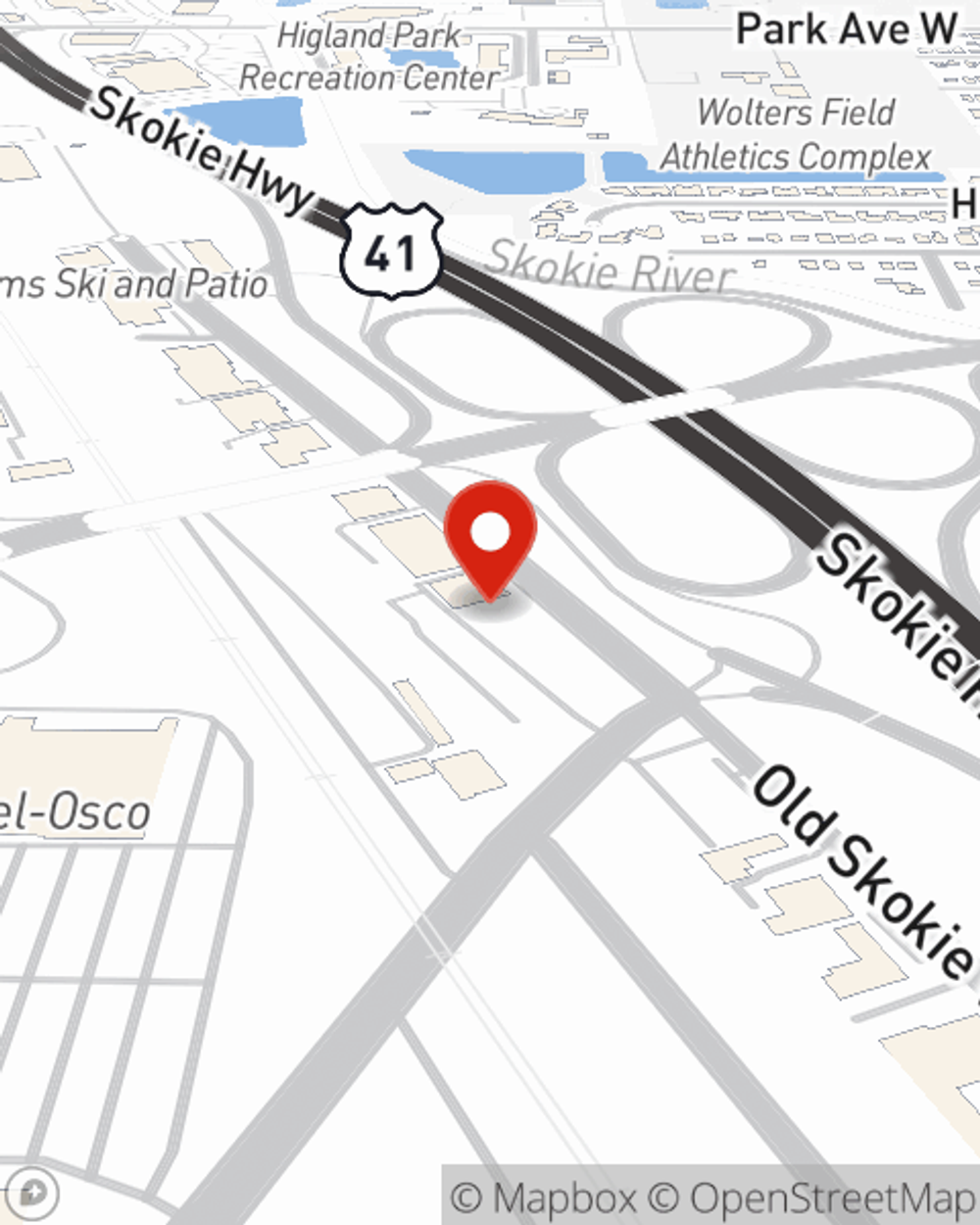

Highland Park, IL 60035-3041

Briergate Bridge

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Location Details

- Parking: In front of building

- Floor #2

- Steps/stairs

-

Phone

(847) 677-8511

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Location Details

- Parking: In front of building

- Floor #2

- Steps/stairs

-

Phone

(847) 677-8511

Languages

Simple Insights®

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Social Media

Videos

Viewing team member 1 of 3

Elizabeth Reyes

Customer Service Manager

License #17900829

Viewing team member 2 of 3

Al Cervantes

Account Representative

License #20458348

Viewing team member 3 of 3

Jon Vazquez

Account Representative

License #20854238